China's wire and cable industry has long been under a production license management system, which created certain entry barriers. However, these barriers are very low, leading to a flood of new companies entering the market. Despite the annual market demand growth of over 10%, the sector suffers from severe overcapacity and fierce competition. As a result, the average equipment utilization rate across the industry is less than 40%, indicating a significant waste of resources.

According to recent data, there are tens of thousands of wire and cable companies in China, making it the world’s largest manufacturer of such products. However, the market concentration among the top five companies is only 8.43%, and even the top 65 companies combined hold just 30% of the market. In contrast, in the UK, just 12 companies control more than 95% of the market. In the US, the top 10 companies have a 67% share, while in Japan, the top seven companies account for 86% of sales. In France, the top five companies capture 90% of the market. Globally, eight major oligopolistic manufacturers control about 25% of the market, with only Italy’s Prysmian Group reaching over 5 billion euros in annual sales.

The low entry barriers, unchecked expansion of production scale, and excessive redundant construction have led to a highly fragmented industry. Many small workshop-style companies lack essential capabilities like production capacity, quality control, and testing. Meanwhile, rising raw material costs have driven some producers to cut corners, resulting in substandard products flooding the market. This not only poses serious safety risks but also puts legitimate producers and distributors at a disadvantage. Foreign firms are increasingly entering the Chinese market, dominating the high-end segment, while only a few Chinese companies can meet international standards and compete globally.

With the implementation of EU directives like WEEE, ROHS, and EUP, a global shift toward greener products has begun. This has created trade barriers for many Chinese manufacturers, weakening their competitiveness in international markets. The issue is not just about technology or product quality—it's also about compliance with evolving environmental regulations.

Economists often refer to Gresham’s Law, which states that "bad money drives out good." In the context of the wire and cable industry, this means that substandard products tend to dominate when consumers are unable to distinguish between quality and counterfeit goods. Industry leaders like Zheng Yonghan of Shenzhen Jinlongyu Group and Guo Tingke of Shenzhen Bendak Group emphasize the need for stronger consumer education. They suggest raising public awareness about product quality and safety, encouraging the use of nationally certified high-quality products, and teaching consumers how to identify fake items. At the same time, they call for stricter enforcement against illegal production and the sale of inferior goods.

For companies, implementing a safety grade certification system could help differentiate quality products and ensure that only qualified firms participate in major projects. This would promote a healthier market environment where good products prevail.

In short, the challenges faced by China’s wire and cable industry are similar to those of many traditional manufacturing sectors—low entry barriers, limited market concentration, intense price competition, and disorderly market practices. Industry experts believe that learning from international experiences, China needs to promote large-scale integration, encourage regional industrial clustering, and push for product differentiation, technological innovation, and strong brand strategies to drive sustainable development.

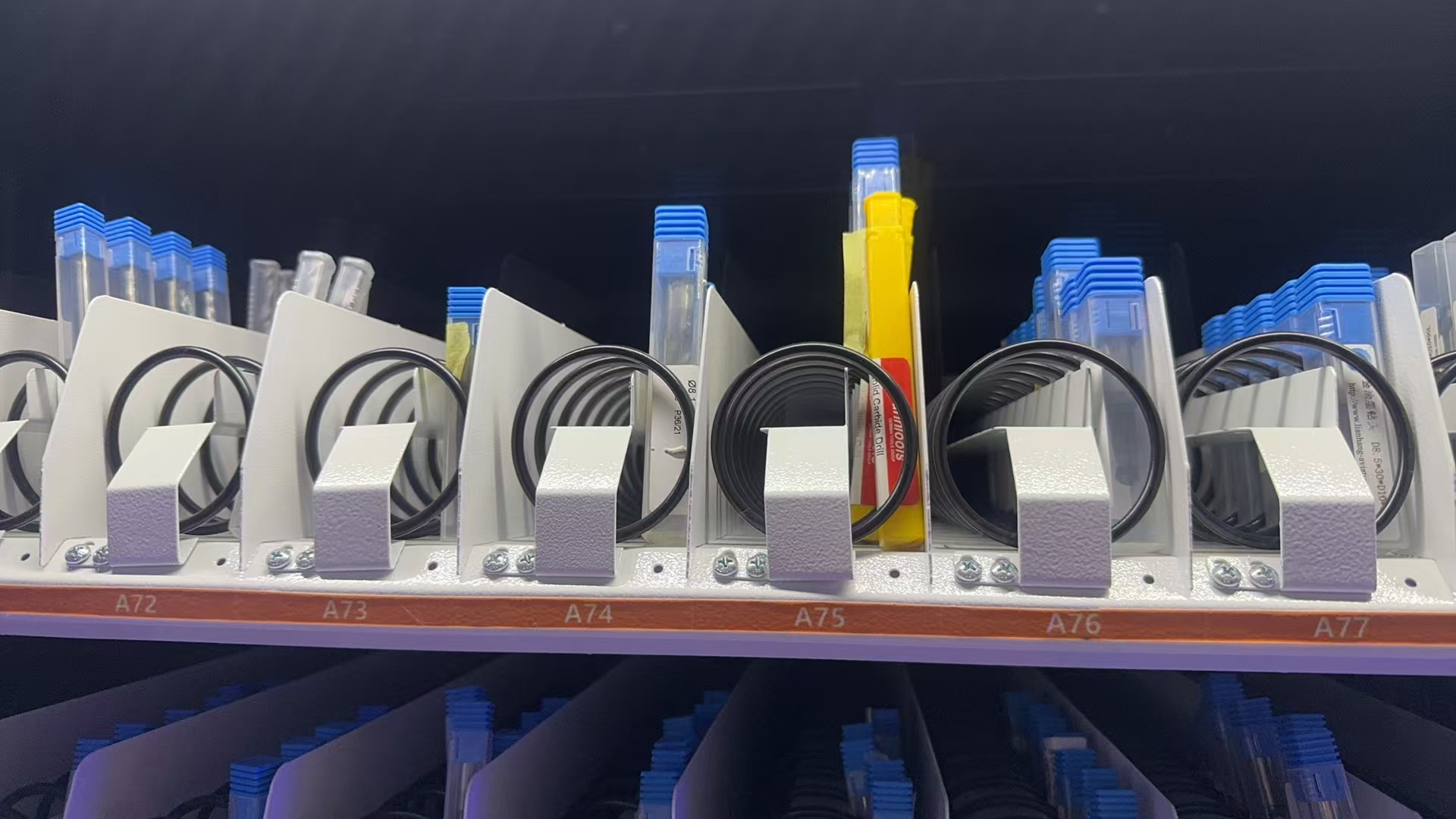

Dual Access Smart Coil & Grid Cabinet

Two dispensing ports for faster, smarter tool distribution

This cabinet combines spring coils and grid compartments with dual access windows, allowing two users to pick up items at the same time. It improves efficiency in busy workshops while maintaining full control over access and inventory.

Each side can be configured independently, supporting different item types such as boxed cutting tools, inserts, gloves, or small parts. With smart access control (RFID, face, code), real-time inventory tracking, and modular design, it’s ideal for factories with high tool turnover.

Applications:

CNC workshops, toolrooms, consumable management in production lines.

Highlights:

Dual user access, mixed storage modes, fast tool dispensing, customizable layout, real-time tracking.

Intelligent Workside Tool Cabinet,Intelligent Tool Handle Management Cabinet,Intelligent Labor Protection Equipment Management Cabinet,Intelligent Tool Management Cabinet

Jiangsu Xicang Intelligent Technology Co., Ltd. , https://www.xciwarehousing.com